Auto Insurance Brokerage: Qualify customers based on vehicle condition

Enhance customer relationships and expand market share with automated processes, offering tailored insurance options based on car condition.

Trusted across industries

How it works

Scan any vehicle

Scan any vehicle effortlessly with our 360° guided system. Visual AI detects damages istantly-no expertise required.

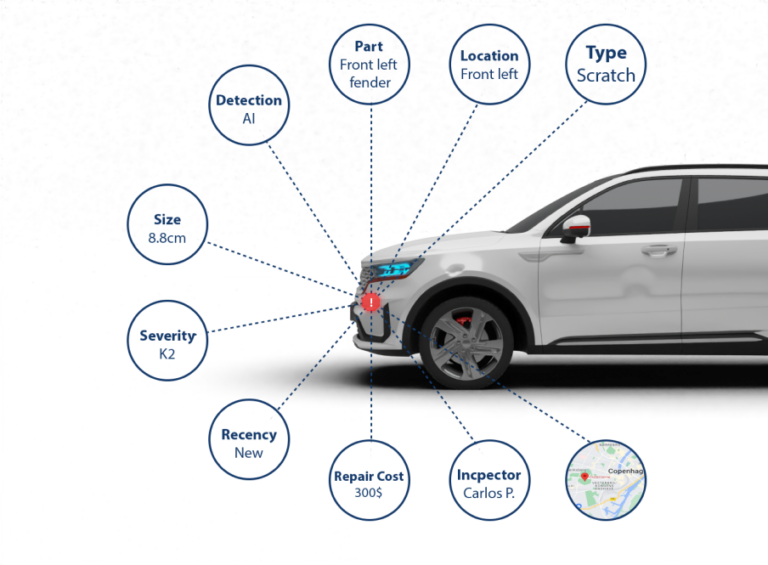

Actional reports

After the scan, a detailed vehicle condition report is generated, logged, and accesible in your system. Receive alerts on new damages and more.

Track and monitor

Manage your damages and inspections from your dashboard. Customize functionality and acces for different user groups.

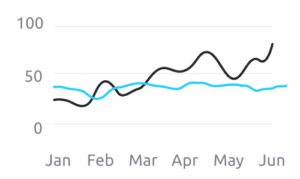

68%

Correct adjudication

Actual vs. planned inspections

67k+

Damages detected

17,254

Inspections completed

AI Use Cases for Auto Insurance Brokers

Pre-policy Inspection

Ensure vehicles are assessed before insurance policies are issued to validate condition and set coverage terms.

Routine Inspections

Track vehicle condition over time, ensuring policyholders maintain the required condition for coverage.

Claim Inspection

Verify the cause and extent of damage (e.g., accident vs. wear and tear), which helps in determining liability and processing claims.

Post-Repair Inspections

After a car has been repaired following an accident, an inspection can confirm that the repairs were properly completed, ensuring that the vehicle is roadworthy and that the insurance provider’s standards are met.

Integrate with any platform

Our solutions works across every platform and integration that your organization may need

Standalone systems

Standalone systems

A mobile app for iOS and Android, plus a web platform for managing inspections and customizing processes and user roles.

Integrated functionality

Integrated functionality

Easily add our features to your existing iOS, Android, or web apps with a quick SDK integration.

Plug & Play API

Plug & Play API

For customers with existing image capture systems, our API analyzes uploaded images for potential damage and returns results in real time.

Time cut in inspection time

Less staff needing to manually inspect

Datapoint processed per inspection

Loved by leaders in Auto Insurance Brokerage

"With Focalx, I'm confident I can grow my business and capture more market share."

Martin Gerlach

Owner & CEO

"At Focalx, complicated solutions are made simple by a team that is good at listening to the market. Input is received with curiosity and they always try to find the best solution for their customers. "

Helle Söderholm

Commercial Director

"Focalx has streamlined our inspection process, saving time and increasing customer satisfaction. Remote inspections give customers flexibility and provide all the details needed at lease end."

Carly Taylor

Manager

Frequently asked questions

We have put together some commonly asked questions

What's the main value Focalx brings to Insurance Brokerage

Focalx helps assess the vehicle's condition in real-time to help brokers offer tailored insurance options based on car condition.

How do you make sure the damages are relevant for me? I don’t report on all damages.

You can customize the AI to focus only on damages relevant to your reporting needs.

Does Focalx offer damage estimation?

No, but we integrate with customer's smart repair pricing lists and third-party tools like Mitchell for damage assessment needs.

Why can’t I use AI detection tools designed for the insurance industry?

Insurance-focused tools prioritize pricing damages rather than high-volume inspections. Our system is optimized for large-scale use and cost efficiency.

Want to see how it works?

Join teams transforming vehicle inspections with seamless, AI-driven efficiency

Further reading

AI-Powered Vehicle Inspections: Transforming Auto Insurance Brokerage with FocalX

The Future of Auto Insurance Inspections

The auto insurance industry has long relied on manual vehicle inspections for claim processing, risk assessment, and fraud detection. However, traditional methods often suffer from inefficiencies, inconsistencies, and high operational costs. AI-powered vehicle inspection technology is reshaping the landscape, offering insurers a way to streamline workflows, improve accuracy, and enhance customer satisfaction.

FocalX is at the forefront of this transformation, providing advanced AI-driven inspection solutions tailored for auto insurance brokerage. By leveraging cutting-edge machine learning algorithms, computer vision, and data analytics, FocalX delivers fast, standardized, and highly accurate vehicle assessments, optimizing the claims and underwriting processes.

How FocalX Enhances Auto Insurance Processes

1. Automated Damage Detection and Assessment

Traditional vehicle inspections can take hours or even days, delaying claims and frustrating policyholders. FocalX’s AI technology reduces inspection times to minutes, automating damage detection through high-resolution image analysis. Our system identifies scratches, dents, structural damages, and wear with unmatched precision, ensuring that insurers have clear, reliable data for claim decisions.

2. Fraud Prevention and Risk Mitigation

Fraudulent claims cost the insurance industry billions annually. FocalX combats this with AI-driven anomaly detection, flagging inconsistencies in damage reports and historical claims data. This proactive fraud prevention helps insurers reduce losses while maintaining trust and transparency with customers.

3. Seamless Integration with Insurance Platforms

FocalX’s AI solutions are designed for easy integration into existing insurance workflows. Whether through APIs or cloud-based dashboards, insurers can deploy our technology without disrupting their operations. This ensures a smooth transition from manual inspections to fully automated, AI-enhanced processes.

4. Enhanced Customer Experience

Customers today expect fast, digital-first services. With FocalX, policyholders can simply upload photos of their vehicles through a mobile app, receiving instant AI-driven inspection results. This eliminates unnecessary delays, reducing claim resolution times and boosting customer satisfaction.

5. Standardized and Objective Evaluations

One of the challenges in traditional inspections is human variability—two assessors may reach different conclusions about the same damage. FocalX eliminates this inconsistency by applying standardized AI models trained on vast datasets, ensuring objective and repeatable results every time.

Addressing Industry Challenges

While AI-driven inspections offer immense benefits, their implementation comes with challenges. FocalX addresses these with a focus on:

- Data Quality and AI Training: Our models are continuously refined using millions of high-quality vehicle images to ensure precise assessments.

- User Adoption and Trust: We provide insurers with clear, explainable AI decisions, increasing confidence in our system’s recommendations.

- Regulatory Compliance: Our solutions align with industry standards and data protection regulations to ensure safe and ethical AI usage.

The Road Ahead: AI’s Expanding Role in Auto Insurance

The integration of AI-powered vehicle inspections is not just a trend—it is the future of auto insurance brokerage. As the industry moves toward greater automation, companies leveraging FocalX will gain a competitive edge through increased efficiency, reduced costs, and improved customer loyalty.

By adopting FocalX’s AI-driven solutions, insurers can revolutionize their claims and underwriting processes, driving innovation while delivering superior service to their policyholders.

Get in touch with FocalX today to see how AI-powered vehicle inspections can transform your auto insurance operations.